Anúncios

Enjoy credit card protection, rewards, low intro APR on balance transfers, and no annual fee

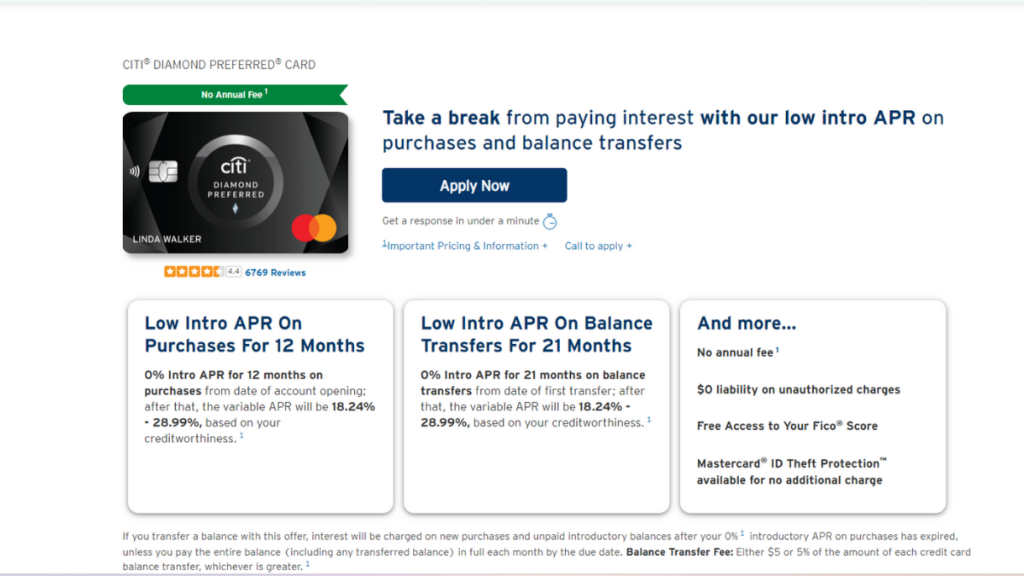

The Citi® Diamond Preferred® Card offers an incredible opportunity to save on interest when paying off debts during the introductory period. The card’s biggest advantage is its 0% introductory APR for 12 months on purchases and 0% introductory APR for balance transfers for 21 months!

If this information has caught your eye, read on to explore this card’s features and discover all the details of this financial product.

Credit Card

Citi® Diamond Preferred®

| Credit Score: | 670 up to 850 FICO score; |

| Annual Fee: | Free; |

| APR: | Enjoy 0% APR for 12 months, then 18.24% up to 28.99%. |

| Welcome Bonus: | 0% intro APR during 21 months on balance transfers; |

| Rewards: | None |

How is Citi® Diamond Preferred® Card performing?

After a detailed examination, the Citi® Diamond Preferred® Card is a solid option despite not being the flashiest on the market.

One of its most notable advantages is the lack of an annual fee, as there tend to be higher rates for people with higher credit scores.

Furthermore, the opportunity to take advantage of Citi Entertainment rewards and receive discounts on entertainment purchases makes it even more attractive.

Anúncios

While it doesn’t offer many extra rewards, the Citi® Diamond Preferred® Card remains one of the top options available that shines in its own right.

A look at the benefits and challenges of Citi® Diamond Preferred® Card

For now, you might be super into this credit card since all we have talked about is benefits. And guess what, we will talk about more!

But, to pop your bubble, we will also take a look at the dark side! Don’t wait around any more, and read them down below!

Anúncios

A closer look at the benefits of Citi® Diamond Preferred® Card

We have so many benefits to tell you about!

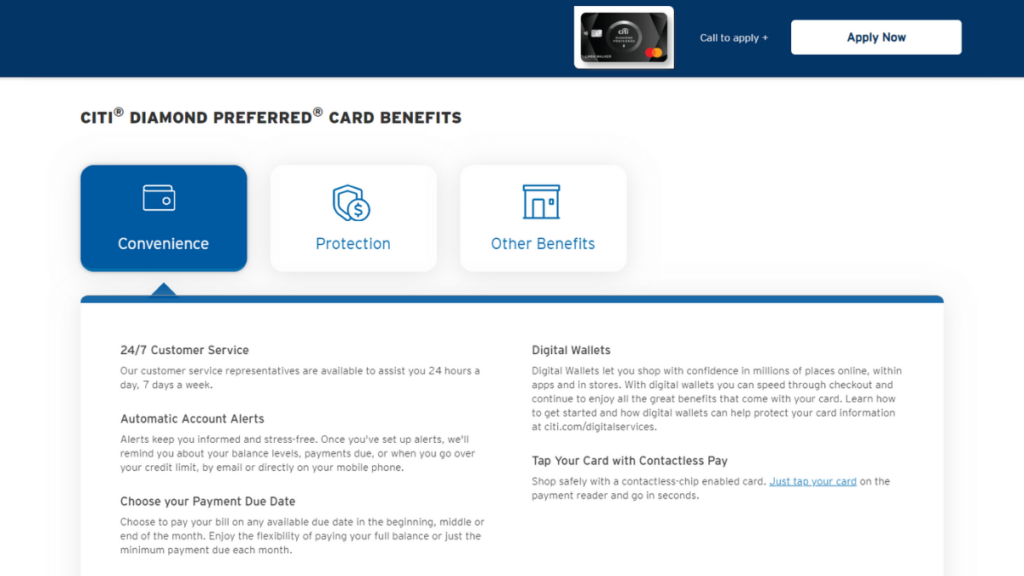

First and foremost, you’ll get access to Citi Entertainment, which is basically a discount voucher for every ticket you purchase with the card.

On top of that, this card has a completely free annual fee! You can get it without making any purchases, just by using it. How cool is that?

Another advantage is the card’s flexibility. Users can choose their payment due date, adapting it to the dates that make sense for their finances.

It also allows for full balance payment or minimum payment only, which is useful in situations when finances are tight.

However, the show’s star is definitely its 0% introductory APR, which allows users to save on interest if they use this period wisely.

A closer look at the challenges of Citi® Diamond Preferred® Card

We can already hear the “pop” of the bubble popping for you. Yes, there is a bad side, but don’t worry, it is not catastrophic. So for our first con, we have a foreign transaction fee.

For the Citi® Diamond Preferred® Card, you must pay at least 3% of the transaction if it is outside your country.

Now, the next one is a bit obvious. The fact that the Citi® Diamond Preferred® Card does not offer any extra rewards. It is not good, but something you can live with for sure.

How to get Citi® Diamond Preferred® Card: a step-by-step guide

One key aspect we’ll cover in this topic is the application methods available to you to get the Citi® Diamond Preferred® Card.

While there’s technically only one method, it’s crucial to know the ins and outs of the process.

So, without further ado, let’s dive in and equip you with everything you need to know to apply for this card successfully.

Essential requirements for qualifications with Citi® Diamond Preferred® Card

You really thought we were going to talk about the tutorial now, right? Well, don’t worry; we will get there; let’s just take a look at what you need to follow to do so.

So, of course, there are a few eligibility requirements you’ll need to meet. First, you must be at least 18 or 21 years old if you reside in Puerto Rico. Additionally, the credit card is only available to individuals who are residents of the United States.

Now, you’re ready to start the application process if you meet these requirements. So keep reading and check out the steps involved!

A guide to submitting your application online

There is only one way to apply for this card, and it is online. You must search Citi’s official website for the Citi® Diamond Preferred® Card.

After that, click on “Apply now” and fill out the form. Submit it, and done! Very easy, fast, and simple.

Credit Card

Citi® Diamond Preferred®

Want something different? Try Wells Fargo Reflect® Card

Well, if you’ve made it this far and, unfortunately, this card doesn’t have what you’re looking for, don’t worry!

There are more fish in the sea than the Citi® Diamond Preferred® Card. The Wells Fargo Reflect® Card can give you an awesome time! Believe us when we say you won’t regret applying for it.

But first, let’s take a look at more information, shall we?

Just click on the link down below to be redirected to get more information about the card.